Diabetes, asthma, depression and attention deficit hyperactivity disorder (ADHD)—these categories are driving utilization and spend in private drug plans. Vishal Ravikanti, Director, Professional Services at TELUS Health, summarized what private payors need to know about these categories—and more—at TELUS Health’s 2023 conference on May 3.

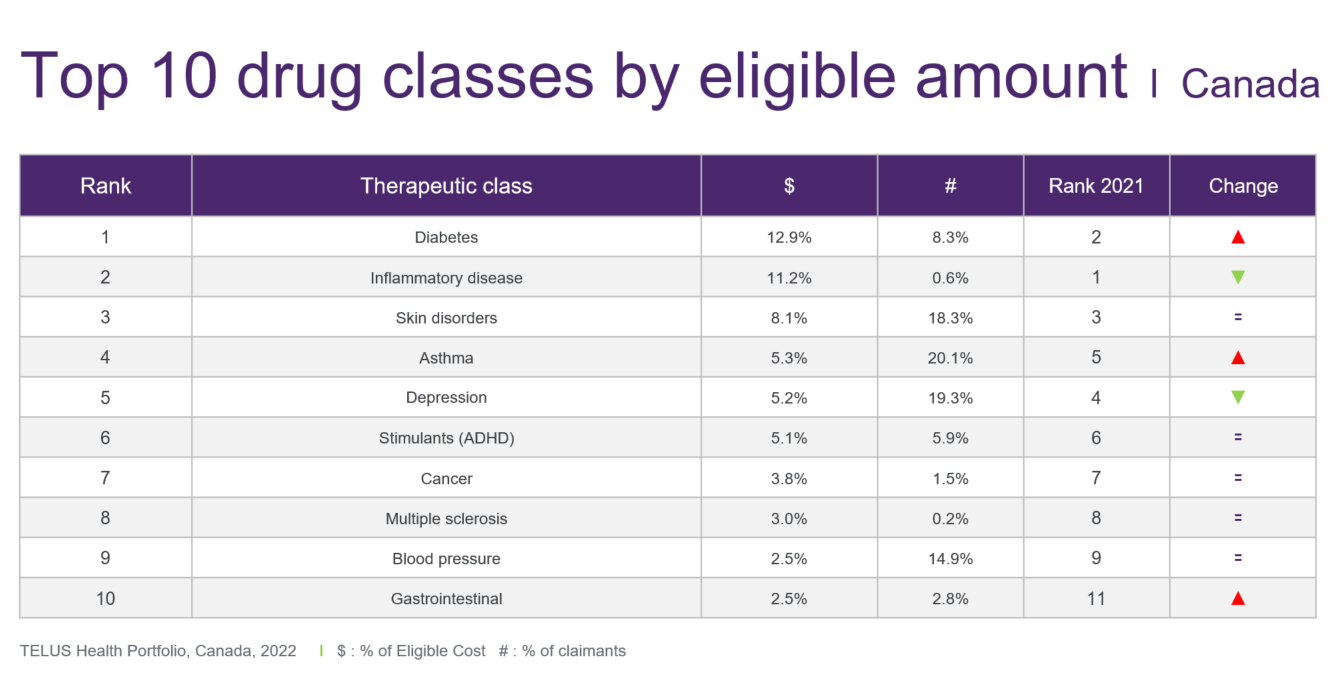

Diabetes – A single medication, Ozempic, was one of the biggest stories in medication use in 2022. Its eligible amount increased by 87.8 per cent to surpass $200 million within TELUS Health’s book of business, which represents more than a quarter of the total diabetes category ($745.2 million). And while the spend for other diabetes products, such as the Freestyle Libre glucose monitor, also grew in 2022, it appears that Ozempic single-handedly vaulted the diabetes category into the number-one spot on the top-10 list of drug categories.

GLP-1 inhibitor drugs, belonging to the category of diabetes medications, have proven effective in managing blood sugar levels. However, they can also be used off-label for weight loss, with distinct brand names assigned to products specifically indicated for weight loss. This raises an intriguing question: to what extent can the growth in GLP-1 usage be attributed solely to its off-label use for weight loss, particularly by plan members without diabetes?

While the data doesn’t capture this level of detail, off-label use can roughly be deduced by separating out claimants who are using the drug as a monotherapy, said Ravikanti. In other words, if the claimant is not taking any other diabetes medication this could suggest off-label use because for people with diabetes, GLP-1 inhibitors are normally a second- or third-line therapy taken with other diabetes medications.

When the claims are considered this way, approximately a quarter of claimants use GLP1’s as monotherapy. “From this we can hypothesize that it’s possible that some of these claimants are using the GLP-1 brands indicated for diabetes,, off-label for weight loss,” noted Ravikanti.

Step therapy, a plan design tool, can mitigate claims stemming from off-label use. "It validates prior diabetes treatment before opening up coverage for the GLP-1 class," said Ravikanti.

Inflammatory disease – For the first time since its launch more than 20 years ago, the eligible amount for Remicade, for rheumatoid arthritis, declined in 2022—by 14.7 per cent.

The same can be said for other originator biologics for which biosimilars have become available, such as Humira and Enbrel. So much so that the category has relinquished its longstanding rank of the number-one drug class by eligible amount, declining by 3.9 per cent in 2022 to $647.7 million in TELUS Health’s book of business.

Provincial programs that require patients to switch to a biosimilar for continued coverage—starting in B.C. in 2019—are largely responsible for what’s happening on the private side.

“We are seeing the deployment of programs on a private payor side to mimic what the provinces are doing. Or, plans have implemented a product listing agreement [with the manufacturer of the originator biologic] to support choice for their members while still managing costs and savings brought to market through biosimilars,” said Ravikanti.

Asthma – The asthma category has resumed its number-four ranking on the top-10 list after dropping to fifth position in 2021. The eligible amount increased by 16.7 per cent in 2022, reaching $306.4 million in TELUS Health’s book of business for private drug plans.

The COVID-19 pandemic was the biggest factor behind these results. “In 2021 with COVID-related restrictions, there was less exposure to airborne disease, patients were less likely to develop respiratory tract infections and therefore there was less use of inhalers and treatments,” explained Ravikanti. “Then in 2022 we returned to more of a pre-COVID lifestyle and saw the reverse scenario, with more exposure and increased upper respiratory tract infections.”

Another source of growth in the asthma category is the use of biologics to treat severe asthma, for which the average annual eligible amount is $20,000. “They continued to grow even when the entire asthma class was decreasing in 2021,” noted Ravikanti.

He added that “it will be important to monitor biologics in disease states that don’t normally have high-cost biologic options, as these represent cost drivers arising from new treatment options for patients.”

Depression – The total eligible amount for depression climbed by 8.4 per cent to reach $303.1 million and fifth position on the top-10 list.

“Most of the growth is driven by utilization and the number of new claimants,” stated Ravikanti.

Plan members under the age of 20 represent most new patients, a trend that began before the pandemic. “The growth rate for claimants in the zero-to-19 age band consistently outpaces the average growth rate of the category,” noted Ravikanti.

Regarding health benefits, he added that it’s important not only to ensure drug therapies are available for plan members and their families, but also mental health counselling to support the treatment of depression.

ADHD – The category of drugs to treat ADHD pushed ahead by 22.1 per cent in 2022 to reach $294.6 million in eligible amount. This puts it within striking distance of depression and asthma. Two drugs—Concerta and Vyvanse—account for the lion’s share of the eligible amount.

While ADHD is commonly a pediatric condition, that patient population is not the source of the surge in utilization. “The 30-to-39 age group showed the strongest growth in terms of claimants in 2022,” said Ravikanti. Claims analysis also shows that this age group began to outpace category growth in 2020.

Impact of COVID-19 – Have pandemic-induced delays in access to care worsened medical conditions? Will this lead to increased costs due to the need for treatments that could have been avoided?

TELUS Health’s analysis of new patients in the categories of cancer, depression and cardiovascular seeks to help answer these questions. Growth, as expected, plateaued in 2020. “We saw this rebound in a large way in 2021 as restrictions eased and patients returned to seeking care,” said Ravikanti.

The good news in 2022 is that new patient counts across all three categories noticeably declined; however, they were still elevated compared to pre-pandemic years. Results from 2023 will likely determine whether growth rates are returning to pre-pandemic norms or remain elevated due to the impact of COVID-19.

Highest-cost claimants – The highest eligible amount for a single medication covered by a private drug plan in 2022 was $1.8 million—more than double the top amount of $700,000 in 2021. The drug was Luxturna for treatment of a rare eye disorder, Canada’s first gene therapy. Three claimants received coverage in 2022.

Strensiq, indicated for a rare bone disease, was next, with an eligible cost per claimant of $1.5 million. Two claimants received coverage.

The highest-volume ultra-high-cost drug was Soliris, for rare blood disorders. Sixty-five claimants received coverage in 2022, with an average eligible cost of $456,445 each. Ravikanti later noted that a biosimilar for Soliris is currently under review by Health Canada, which could result in significant savings for payors.

In total, the eligible amount for the 10 most costly products, for 106 claimants, was $56.5 million in 2022, an increase of 7.5 per cent over 2021.

The federal government’s national strategy for the coverage of drugs to treat rare diseases, currently underway, may be the primary source of cost relief for private plans. “Since these drugs are typically intended to treat rare diseases, they may be taken into consideration during the development of the rare disease program that may be rolled out at the federal or provincial level,” said Ravikanti.

Generics for high-cost drugs – Ravikanti highlighted that Health Canada has begun to review and approve generics for high-cost drugs that are not biologics. “These are drugs with an expected annual cost of over $10,000. Generics in this space can provide cost relief of up to 75 per cent.”

That’s because these generics may fall under the pricing framework of the pan-Canadian Pharmaceutical Alliance, which kicks in for brand-name drugs covered by a provincial plan. The level of savings depends on the number of generic alternatives and the route of administration. “Where the province does not provide coverage for these products, the savings, while still significant, will be lower,” said Ravikanti.

Uptake of biosimilars – In provinces with a government biosimilar switching policy, the number of private drug-plan claimants for biosimilars grew from 16.5 per cent of all biologic claimants in the first quarter of 2021 to 46.7 per cent in the fourth quarter of 2022. This reflects private plans’ adoption of their own biosimilar policies.

In contrast, the share of biosimilar claimants in provinces without switching policies climbed at a much slower rate, from 7.9 per cent to 15.1 per cent during that two-year period.

In his presentation, Ravikanti also discussed Canada’s drug pipeline, National Pharmacare, reforms by the Patented Medicine Prices Review Board and a national strategy for drugs to treat rare diseases.

View the full presentation: